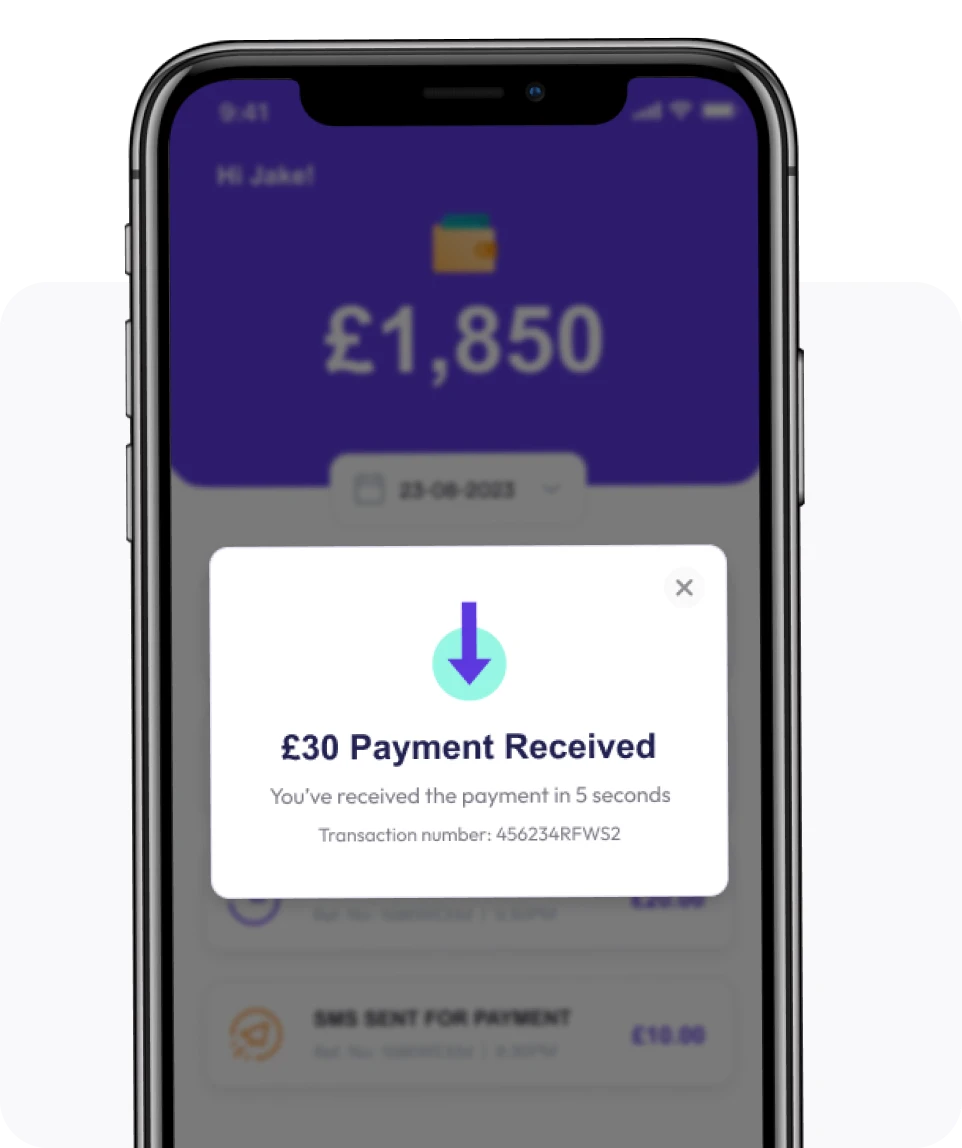

Quicker settlements: Receive payments instantly once your customer pays in store or at their door, ensuring timely revenue

Accept up to £5000: You can take payments up to £5000 per transaction with instant settlement"

Seamless Transactions: Ditch the cards, our QR Quick Pay system provides a smooth and hassle free experience for both you and your customer

Whether big or small, our QR Quick Pay fits. Enjoy savings and control as you grow.

Whether you're at your charming cafe or visiting clients' homes as a handyman – take payments then and there with just a quick scan.

QR Quick Pay is convenient, secure and professional. No more worries about wrong bank details or late payments.

No Contracts, No Worries: Enjoy the freedom of signing up without any binding contracts – it's your business, your terms.

Transparent Pricing: Say goodbye to hidden fees and unexpected charges – with us, what you see is what you get.

Minimal Transaction Fees: With just a 0.59% transaction fee, we help you maximize your profits while offering top-notch payment solutions.

Faster Settlements: NulaPay enables swift and direct transactions, reducing delays in receiving funds for products or services.

Customer Contacts: Turn every transaction into an opportunity to collect customer details for future marketing and engagement.

Collect Feedback: After payments, Customers are prompted for a Google review, shining a light on your business.

No Chargebacks: Eliminate chargeback hassles with NulaPay's secure, reliable QR code system, reducing risks and enhancing transaction safety.

Signup to NulaPay

Enter bank account details

Start accepting payments

When customers are ready to pay, they scan the QR code that you generated, which initiates an account-to-account (A2A) payment in their smartphone browser. They confirm their identity with a face or fingerprint scan in their banking app to approve the payment, and the funds are instantly released to your business. This method makes transactions convenient and secure for both you and your customers.

Here's how it works: The customer scans a NulaPay QR code or clicks a payment link, which opens their banking app. They approve the payment, and the money is transferred to the business bank account in seconds. This means businesses get their money right away and save up to 70% compared to using traditional card payments.

NulaPay skips the Visa and Mastercard networks and uses the UK's secure Faster Payments and Open Banking networks. The UK Financial Conduct Authority oversees every transaction, and banks handle all the money directly, so NulaPay never touches your funds.